In 1974 the U.S. Congress established the federal public housing program known as Section 8. This program was set up to assist low income families to acquire quality housing. Decades later, the program’s flaws were exacerbated and as a result, many Section 8 residents are stuck under the poverty line while often living in high crime neighborhoods and low quality homes. The Biden administration has a chance to reform federal public housing programs; expanding the budget alone will not cut it, smart policy reforms have to be made in order to use the government funds more efficiently (1). As a result, more Americans will get more housing assistance. In the past decade, some policy solutions to improve Section 8 housing were proposed (2)(3), but since Covid-19 has started the housing crisis has worsened. This article looks into the source of the issues that are keeping federally aided residents under the poverty line. Today Section 8 is synonymous with federal public housing programs that are meant to assist families find better housing. Eligible applicants have the option to use their Section 8 vouchers on a wide range of apartments and single family homes in safe and prosperous neighborhoods. In practice, many Section 8 residents encounter two major challenges when attempting to rent a quality property:

- Section 8 vouchers are limited by the Fair Market Rent value, which is determined by an annual rental rate average for the region. Since the regions calculated are quite large, the maximum FMR rate is relatively low and thus making it difficult to find quality housing in city centers next to employment opportunities (4).

- Many landlords discriminate against Section 8 residents out of prejudice. Some states have prohibited landlords from discriminating by source of income. Even with this legislation in place, landlords can still avoid federally-aided residents by not qualifying their properties to the program’s standard. Between 2010-2016, over ten thousand Section 8 properties left the market (4).

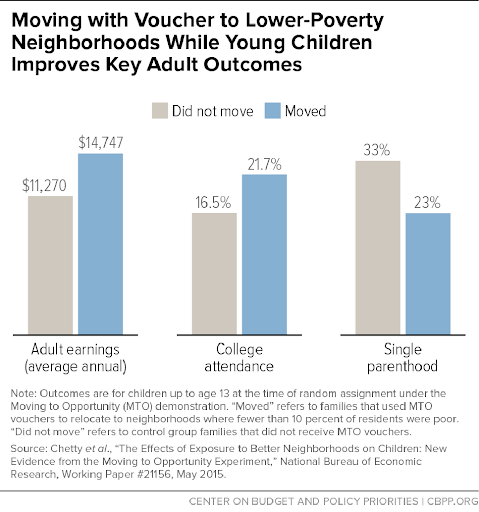

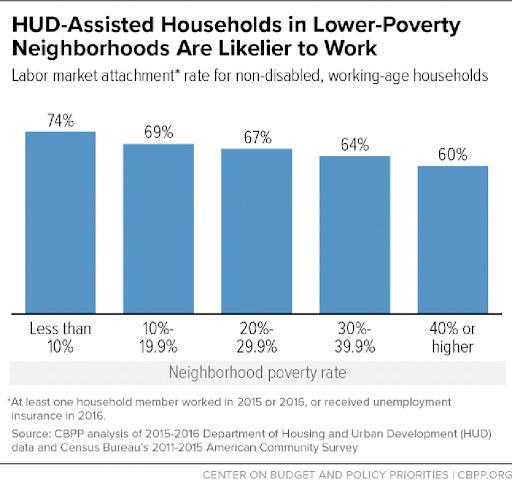

On the other hand, landlords in high crime, low quality neighborhoods are happy to get their Section 8 families over low income families since rent is always on time.  The impacts of living in low quality neighborhoods can be brutal. A review by the Center on Budget and Policy Priority found that families in poor neighborhoods have less employment opportunities, especially for children who grow up in these environments (5). Federally aided families who resided in low crime areas got better education and opportunities for their children in comparison to Section 8 residents who chose inner city high crime neighborhoods. Low crime neighborhoods also have better amenities, education and community programs, as well as parks. Therefore, more Section 8 housing choices in low crime neighborhoods can help residents break out of poverty (Figures 1, 2).

The impacts of living in low quality neighborhoods can be brutal. A review by the Center on Budget and Policy Priority found that families in poor neighborhoods have less employment opportunities, especially for children who grow up in these environments (5). Federally aided families who resided in low crime areas got better education and opportunities for their children in comparison to Section 8 residents who chose inner city high crime neighborhoods. Low crime neighborhoods also have better amenities, education and community programs, as well as parks. Therefore, more Section 8 housing choices in low crime neighborhoods can help residents break out of poverty (Figures 1, 2).  Figure 1. Moving with Voucher to Lower Poverty neighborhood While Young Children Improves Key Adult Outcomes

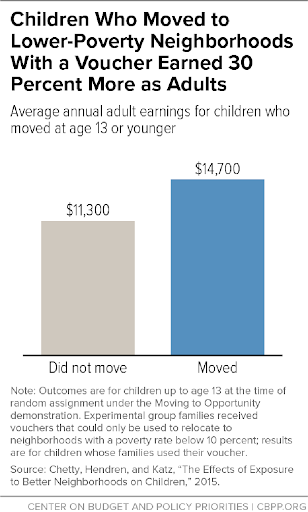

Figure 1. Moving with Voucher to Lower Poverty neighborhood While Young Children Improves Key Adult Outcomes  Figure 2. Children Who Moved to Lower Poverty neighborhoods with a voucher earn 30% more as adults. Public housing buildings in large cities are generally neglected. In addition to high crime rates, mold and piping problems are causing health conditions (2). On the other hand, these neglected homes are sheltering many Americans. Often, these public housing neighborhoods get stuck in a poverty cycle that keeps them ‘frozen’ in terms of financial mobility. With the increased demand for suburban single family homes during Covid-19, many Section 8 families have no choice but to choose low quality neighborhoods. With the long waiting lists for Section 8 vouchers, the homelessness crisis is worsening as the U.S. had 580,000 homeless Americans in January 2020 according to the New York Times (6).

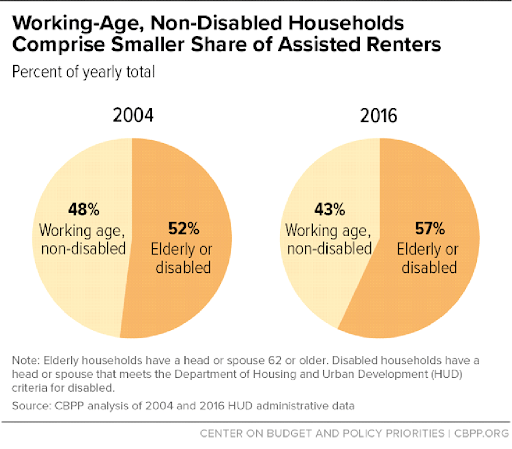

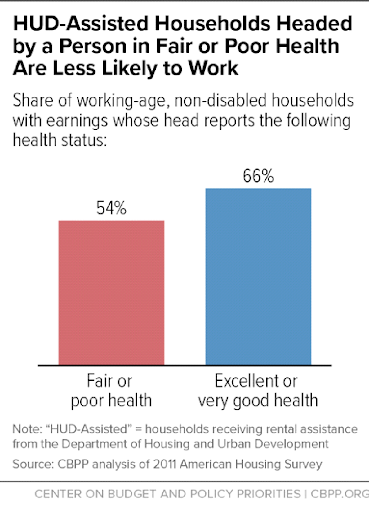

Figure 2. Children Who Moved to Lower Poverty neighborhoods with a voucher earn 30% more as adults. Public housing buildings in large cities are generally neglected. In addition to high crime rates, mold and piping problems are causing health conditions (2). On the other hand, these neglected homes are sheltering many Americans. Often, these public housing neighborhoods get stuck in a poverty cycle that keeps them ‘frozen’ in terms of financial mobility. With the increased demand for suburban single family homes during Covid-19, many Section 8 families have no choice but to choose low quality neighborhoods. With the long waiting lists for Section 8 vouchers, the homelessness crisis is worsening as the U.S. had 580,000 homeless Americans in January 2020 according to the New York Times (6).  Figure 3. Employment of Assisted Renters. Most federally assisted residents do not break out of poverty due to various housing programs. A CBPP report points out that 57% are unable to work. Out of the 43% who are able to work, only two thirds are currently employed and most of them are having difficulties paying their rent. 56% of employed residents are still under the poverty line. (Figure 3)

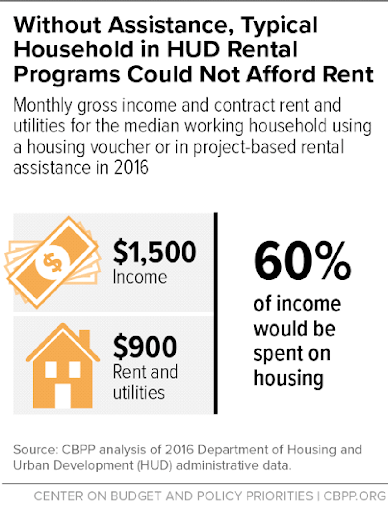

Figure 3. Employment of Assisted Renters. Most federally assisted residents do not break out of poverty due to various housing programs. A CBPP report points out that 57% are unable to work. Out of the 43% who are able to work, only two thirds are currently employed and most of them are having difficulties paying their rent. 56% of employed residents are still under the poverty line. (Figure 3)  Figure 4. Public Housing breakdown The CBPP illustrates the average Section 8 family as a 38 year old single mother of two, with an annual income of $18,200 on average (which is below the poverty line in 2016)(4). That means she can only afford to pay about $450 for rent and utilities. But the median rent for a two-bedroom apartment in the United States is $963 per month, which means that without rental assistance she cannot afford an apartment without paying over 30 percent of her monthly income. Without rental assistance, she would pay 60% of her income for rent, leaving $600 to cover other monthly expenses.

Figure 4. Public Housing breakdown The CBPP illustrates the average Section 8 family as a 38 year old single mother of two, with an annual income of $18,200 on average (which is below the poverty line in 2016)(4). That means she can only afford to pay about $450 for rent and utilities. But the median rent for a two-bedroom apartment in the United States is $963 per month, which means that without rental assistance she cannot afford an apartment without paying over 30 percent of her monthly income. Without rental assistance, she would pay 60% of her income for rent, leaving $600 to cover other monthly expenses.  Figure 5. Employment rates and medical conditions Out of eligible residents who are able to work, about 20% did not work at all between 2012-2016 and 48% worked only part of this period according to the same report by the CBPP (Figure 6). The report points out a correlation between unemployment rates to medical conditions and education levels of federally-aided residents and a correlation between low crime rates and low unemployment rates whereas families who reside in high crime inner city neighborhoods statistically don’t break out of the poverty cycle. Additionally, It found that families with children tend to have higher employment rates.

Figure 5. Employment rates and medical conditions Out of eligible residents who are able to work, about 20% did not work at all between 2012-2016 and 48% worked only part of this period according to the same report by the CBPP (Figure 6). The report points out a correlation between unemployment rates to medical conditions and education levels of federally-aided residents and a correlation between low crime rates and low unemployment rates whereas families who reside in high crime inner city neighborhoods statistically don’t break out of the poverty cycle. Additionally, It found that families with children tend to have higher employment rates.

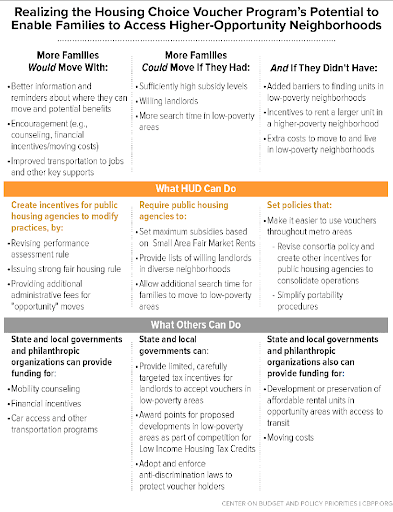

Figure 6. Employment of assisted residents by local poverty rates The information illustrated in the graphs show significant advantages in living in low poverty neighborhoods in comparison to high crime neighborhoods. These advantages allow better conditions for breaking out of poverty although the challenges prevent residents from renting in better areas. These challenges form rigid patterns hurting low income families. The Housing and Urban Development suggests a few solutions in order to assist Section 8 residents to find housing in better living environments (Figure 7):

Figure 6. Employment of assisted residents by local poverty rates The information illustrated in the graphs show significant advantages in living in low poverty neighborhoods in comparison to high crime neighborhoods. These advantages allow better conditions for breaking out of poverty although the challenges prevent residents from renting in better areas. These challenges form rigid patterns hurting low income families. The Housing and Urban Development suggests a few solutions in order to assist Section 8 residents to find housing in better living environments (Figure 7):

- Creating incentives for landlords who have properties in low crime areas

- Reducing Fair Market Rent radius

- Extending the period for finding an apartment (Currently 60 days)

- Guidance for Section 8 residents

- Recommended landlord lists

- Public transport improvements

- Creating incentives and benefits for choosing the right type of housing

- Increased enforcement of Section 8 responsibilities, such as prohibiting drug use and crime.

Figure 7. Policy ideas for improving public housing programs After decades of federal rental assistance programs in place, there are many significant flaws challenging it from achieving its goals. Millions of American families getting rental aid are in desperate need for solutions to help its residents break out of poverty. Incentives for landlords and additional legislation that would encourage low income families to move to better neighborhoods. Before the Biden administration acts to expand public housing budgets, it has to examine its downsides in order to reduce socio-economic disparities. Right now, public housing only reduces homelessness, but keeps them in poverty. If the budget grows without policy reforms, the federal government would only spend more to reduce more homelessness but preserve the same issues. Sources:

Figure 7. Policy ideas for improving public housing programs After decades of federal rental assistance programs in place, there are many significant flaws challenging it from achieving its goals. Millions of American families getting rental aid are in desperate need for solutions to help its residents break out of poverty. Incentives for landlords and additional legislation that would encourage low income families to move to better neighborhoods. Before the Biden administration acts to expand public housing budgets, it has to examine its downsides in order to reduce socio-economic disparities. Right now, public housing only reduces homelessness, but keeps them in poverty. If the budget grows without policy reforms, the federal government would only spend more to reduce more homelessness but preserve the same issues. Sources:

- Capps, K. (2021, October 7). Can Biden Deliver on His Promise to Expand Housing Vouchers? Bloomberg.com. Retrieved December 25, 2021, from https://www.bloomberg.com/news/articles/2021-10-07/biden-pledge-to-boost-section-8-housing-faces-congress

- Demsas, J. (2021, July 22). America’s houses are old. low-income renters are suffering because of it. Vox. Retrieved December 25, 2021, from https://www.vox.com/2021/7/22/22586701/housing-aging-public-housing-section-8

- Capps, K. (2019, August 5). How a Section 8 Experiment Could Reveal a Better Way to Escape Poverty. Bloomberg.com. Retrieved December 25, 2021, from https://www.bloomberg.com/news/articles/2019-08-04/a-cheap-powerful-tool-to-beat-housing-segregation?sref=QFCZ3YPm

- Semuels, A. (2015, July 13). America’s shame: How U.S. housing policy is failing the country’s poor. The Atlantic. Retrieved December 25, 2021, from https://www.theatlantic.com/business/archive/2015/06/section-8-is-failing/396650/

- Mazzara, A. (2018, February 5). Chart Book: Employment and earnings for households receiving Federal Rental Assistance. Center on Budget and Policy Priorities. Retrieved December 25, 2021, from https://www.cbpp.org/research/housing/chart-book-employment-and-earnings-for-households-receiving-federal-rental

- Thrush, G. (2021, March 18). Homelessness in U.S. rose for 4th straight year, Report says. The New York Times. Retrieved September 19, 2021, from https://www.nytimes.com/2021/03/18/us/politics/homelessness-coronavirus.html

- Acosta, S. (2021, March 11). An agenda for the future of public housing. Center on Budget and Policy Priorities. Retrieved December 25, 2021, from https://www.cbpp.org/research/housing/an-agenda-for-the-future-of-public-housing

- Capps, K. (2021, May 20). The Incentives That Might Make Landlords Take Section 8 Tenants. Bloomberg.com. Retrieved December 25, 2021, from https://www.bloomberg.com/news/articles/2021-05-20/landlord-bonuses-aim-to-reform-section-8-housing

- Diane Yentel and Nan Roman, opinion contributors. (2021, October 14). Seizing a once in a lifetime opportunity to end homelessness in the US. TheHill. Retrieved December 25, 2021, from https://thehill.com/blogs/congress-blog/politics/576664-seizing-a-once-in-a-lifetime-opportunity-to-end-homelessness-in

- Mock, B. (2015, June 12). The Case for Raising Housing Vouchers for Higher Rent Neighborhoods. Bloomberg.com. Retrieved December 25, 2021, from https://www.bloomberg.com/news/articles/2015-06-11/how-to-help-low-income-families-gain-better-access-to-high-opportunity-neighborhoods?sref=QFCZ3YPm